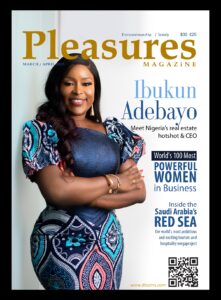

Pleasures Magazine features the innovative real estate entrepreneur, Dr Ibukun Adebayo, on its March/April 2023 Cover edition.

Ibukun Adebayo is Founder and CEO of Rock Realty Limited, a real estate advisory and development company she founded in 2016, which she has nurtured from scratch to etch its niche offerings in Nigeria’s effusive market. She reflects on the power of collaboration in the housing sector.

She shared the story of her transitioning from being a full-time physician to becoming a successful entrepreneur with Pleasures Magazine.

“It was really a journey. It was a journey that first started with me practicing as a doctor, but I did not find fulfillment in the practice of medicine, so I knew I needed to explore something else. The question was, what was I going to venture into? I initially tried to do a few other things while I was still practising. One of those was interior decoration. I did some courses on this. I knew I loved it, but I wanted to do more.” This meant that the search continued in response to the longing to unlock and unleash the inbred entrepreneurial instincts in me. Then a friend of hers suggested that she considers a career in finance. Though she had not done numbers for a long time, Ibukun gave the idea a shot.

She added: “He invited me to intern at his organization, an Investment Management and Training Firm. He said to me, when you are not working as a doctor, come around and see if you would like it here. I had barely started when I suddenly realised that I ticked with doing numbers, and I started spending more days working in that office as an investment analyst. I found that the world of investment management and finance was beautiful. Gradually, I started doing only night jobs as a doctor and working in the investment training firm during the day, as an analyst. I started learning on the job, but the good thing was that the organization was strategic for a novice like me at that time. It was an investment training firm, so when the organization had training sessions for client companies, I went as part of the administrative team and I had the opportunity to listen in on the training sessions. So, it was a blend of working and training for me and that was how I got into the investment management industry.”

The real deal and dream for the real estate business started loading as she continued in the investment management space in other companies, the last of which was in Chapelhill Denham Management where she worked in the private wealth management department. Most high Networth Individuals, she said, had real estate as a big part of their portfolio. That meant that a big part of the portfolio that she managed was real estate. This, of course, meant that she needed to learn about real estate as an investment/asset class.

She told Pleasures Magazine: “While I was at Chapelhill, I was invited by The Infrastructure Bank to head the real estate department of the bank, I took the offer and became the head of the real estate department, a role I held for six years. So, my stint in real estate started fully, and after six years at The Infrastructure Bank, I founded Rock Realty Limited as a middle income focused real estate advisory and development firm. So, that’s my journey from medicine into real estate.”

How would she paint a portrait of Rock Realty to an inquisitive client? “I won’t be able to paint that if I don’t tell you about the motivation for Rock Realty, she said.

She further said: “The motivation for Rock Realty came from a pain-point for middle income earners who in other climes, would be able to get homes easily because once they have good jobs, they are able to access mortgages. In Nigeria, many of these middle income earners earn well, eat well, holiday well, and have decent regular monthly inflows, but they are not able to buy homes because mortgages are not a very common phenomenon in Nigeria. The popular home-purchase models in the country require them to pay tens of millions within a 12 to 18-month period which their earnings pattern does not support. So, they get locked in the rental cycle endlessly. I experienced that. I had good jobs but I really could not get a home until I became an entrepreneur and had access to income in larger bulk patterns.

“So, the pen portrait for Rock Realty is a company that focuses on working with middle-income earners to own their homes using a blend of easier payment plans and mortgages that simulate their earnings pattern. Our projects are structured to enable middle income earners purchase homes using a blend of the National Housing Fund Mortgages (from the Federal Mortgage Bank of Nigeria) and mortgages from other Primary Mortgage Banks. Our advocacy to middle income earners about mortgages being the low-hanging fruits that allow them get on the homeownership ladder and working with them through the process of obtaining mortgages have been our stand-out factors. This is because mortgages are still largely untapped in the Nigerian real estate industry and most real estate developers do not currently structure their business models around mortgage buyers. We usually target companies and provide our projects as solutions to their staff en-bloc, even though we also sell to cash-buyers and individual offtakers. We look forward to having many more investors, local and international who will realise the mammoth potentials in Nigeria’s middle-income housing and mortgage space. Rock Realty’s focus over the next decade is to attract long-term financing into the Nigerian middle income real estate space and mortgage industry so that the potentials that exist in this space can be unlocked significantly, both for the buyers and the investing community.”

The other handle of Rock Realty is that the company is currently working with the Nigerians in Diaspora Commission (NIDCOM) to set up the Diaspora Cities in different locations in the country. The first two Diaspora Cities, in Abuja and Lagos are programmed for commencement in the second and third quarters of this yea. Asides cash sales, Nigerians in Diaspora would also be able to access single digit-rate mortgages. The Diaspora Cities concept can itself be amplified if long-term United States Dollar (USD) financing is available to be funnelled into providing USD-denominated mortgages for Nigerians in Diaspora to buy homes back in Nigeria. This would imply that investments in USD are used to create USD-assets (USD Mortgages) and repayments are also in USD, thereby removing the FOREX risk from Dollar investments in the Diaspora Mortgages.

One of the biggest challenges in the Nigerian real estate market in the country is the lack of long-term capital both for construction and more importantly, for buyers in terms of mortgages. Rock Realty is navigating the waters and working with partners to still create access to mortgages with terms that are more friendly than they would otherwise be able to access. Ibukun says if the world of mortgages is unlocked, the potentials of the middle-income market in Nigeria would astound all industry participants. She says: “It is the same challenge with Nigerians in Diaspora who want to buy homes back in Nigeria. If we can unlock significant financing into the mortgage sector, particularly if we can do foreign financing against USD-denominated diaspora mortgages, we would open up the middle-income market significantly, and that is a massive market in Nigeria.”

The company currently has striking projects in construction, two in Lagos, and one in Ibadan. The current total project pipeline is 300 residential units. The ones in Lagos are called the Bold Living Apartments series. The Concept of the Bold Living Apartment is that the middle-income earners need to get bold and get on the home ownership ladder. Bold Living One comprises beautifully designed apartments on four floors located on Alpha Beach road, Lekki. They also come with modern architecture, and serene ambience. Bold Living Two, a serviced estate currently in construction, simulates the typical condominiums style for exquisite living in upwardly mobile communities. The project is also located in Lekki, Lagos. It is delivered with Gym, Mini mart, , Co-work space, Bar/lounge area and play area.

What could make her business model work better and give an edge in the market? She is starting relationships with some credible international finance organizations who can provide financing such that home buyers can access cheaper, longer-term mortgages. The effect of this initiative will leave the market in a bubblier mode and would be loud in the industry.

Available in print and digital, for front door delivery, click here.