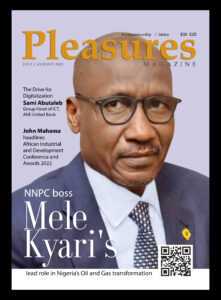

- Patriotic citizens, such as Malam Mele Kyari, make history through their deeds, accomplishments and what they contribute to their country. Mele Kyari stands out with those great men, history-makers and nation builders.

The Group Managing Director of the Nigerian National Petroleum Corporation (NNPC), Malam Mele Kyari has been shortlisted for the ‘2022 African Industrial and Development Award.

The award recognises Mele Kyari’s global influence and visionary approach towards the oil and gas industry, demonstrating strategic thinking and innovative direction in shepherding the growth of Nigeria’s business and the wider oil and gas industry.

The phenomenal success of the Nigerian National Petroleum Corporation (NNPC) can be attributed to his strategic management and leadership. He has been long known as an industry pioneer, contributing to the sustainable growth of Nigeria, and leaving an impact within the country and beyond.

Mallam Mele Kolo Kyari’s appointment as the 19th Group Managing Director of the Nigerian National Petroleum Corporation by President Muhammadu Buhari on Monday, July 8, 2019, has taken the national oil company away from the image and shackles of a behemoth with a negative narrative and tag of a cesspool of corruption and opacity.

Three years on, he has seen and used his appointment as a lifetime opportunity and vista to break away from the decadent past to chart a course correction and a new direction that has renewed stakeholders’ hope.

This has also laid him under necessity to unfold the Transparency, Accountability and Performance Excellence (TAPE) Agenda for the corporation’s rebirth.

Before his appointment, the Maiduguri-born Geology graduate from the University of Maiduguri, Bornu State, was the Group General Manager in charge of the Crude Oil Marketing Department (COMD) and had worked with the NNPC traversing the Nigerian oil and gas industry for more than three decades.

From a corporation that was still steeped in the negative image of a national oil company where nothing seemed to work on assumption of office, Kyari has worked to tweak operations and make big positive things happen with his five-step strategic roadmap that has enthroned efficiency and global excellence.

His management team’s achievements

- The AKK Pipeline Project

Seen as the core of the country’s economic growth, Kyari has pursued the execution of the project with vigour and focused commitment to ensure its 2023 completion deadline.

- Passage of Petroleum Industry Act (PIA)

The executive management of the corporation played important parts to ensure the passage and signing of the epochal PIA into Law by President Muhammadu Buhari on August 16, 2021. President Muhammadu Buhari shocked his many detractors when, in a historic move, he signed into law the Petroleum Industry Bill (PIB) – now the Petroleum Industry Act (PIA). This remains a major feat and one of the boldest, flagship executive actions by the Buhari administration. It also a milestone accomplishment by the NNPC team under Kyari’s watch.

- Incorporation of Nigerian National Petroleum Company Limited under CAMA on September 22, 2021, with the registration number: RC — 1843987.

- Uninterrupted Fuel Supply

This was not experienced prior to his appointment due to hiccups in the supply of petroleum products. It is now a common feature, giving people and businesses the opportunity to plan more efficiently.

- Strategic Fuel Reserve/Refineries Repairs

Mele Kyari positioned the NNPC ahead and built a strategic reserve of more than two billion litres of PMS the country could fall back on to overcome temporary shocks.

- Involvement of NNPC’s Local Workforce

Under this, Kyari ensured NNPC engineers working with the National Engineering and Technical Company (NETCO), the engineering and technical subsidiary of the corporation, would be deeply involved in working with KBR, the original owners of the engineering technology for the refinery rehabilitation projects to handle the refineries’ rehabilitation programme. Feasibility studies have already been completed for the construction of a condensate refinery, while the NNPC has given its commitment to sustain seamless supply and distribution of petroleum products. After the rehabilitation of the refineries, Kyari said the NNPC has agreed with the government to take away the management of the refineries from the bureaucracy and hand them over to private investors, as past experiences confirmed the government cannot handle business effectively. Kyari has disclosed that the contract for the operation and management (O&M) of the rehabilitated refineries would be put up for bid by qualified professional managers to take over and manage. The essence of this is to erase the bureaucratic bottlenecks and ensure the refineries functioned more efficiently and transparently.

- Regulatory Compliance

Under this falls the implementation of International Financial Reporting Standards (IFRS) 9, 15 and 16 across NNPC Group to ensure regulatory compliance. He has also implemented the Centralized Invoice Processing System, integration of systems, applications and products to Remitta, SAP Funds management and issued conditions for financial autonomy of NNPC Special Business Units (SBUs.)

- Roll out of Integrated Management Systems

Kyari has automated NNPC’s operations by rolling out the SAP enterprise management software in performance management, procure to pay, travel management to ensure an automated and integrated operational process.

Also inaugurated the NNPC Delivery Team charged with the responsibility of ensuring the effective performance tracking of top five priorities across the business as well as launching the NNPC Code of Conduct and Tip Portal.

Leveraged on the existing Direct-Sales-Direct-Purchase (DSDP) product supply arrangement he started and sustained while in office as the GGM COMD of the NNPC, to guarantee energy security for Nigerians.

- Final Investment Decision on $3.6bn methanol plant in Bayelsa.

The plant expected to produce 10, 000 tons of methanol daily is an integrated methanol and gas project in Odioma, Brass Island, Bayelsa State scheduled to commence operation in 2024.

- US$260m Funding Agreement for ANOH Gas Processing Company Limited (AGPC).

The project has capacity to deliver 300 million standard cubic feet of gas per day and 1,200 megawatts of electricity to the domestic market.

- Launch of Nigerian Upstream Cost Optimization Programme (NUCOP) to reduce the cost of crude oil production in the country and ensure its continuing competitiveness in the global market.

- Award of $1.5 billion contract for Rehabilitation of Port Harcourt Refinery to Tecnimont SPA of Italy. This has seen the Federal Executive Council (FEC) approve the sum of $1.48 billion for the rehabilitation of both Warri and Kaduna refineries.

- Commercialization of OML 143 Gas13 Execution of OML 118 (Bonga) Agreements between NNPC & Partners.

- Shareholder Agreement for Brass Petroleum Product Terminal (BPPT).

When completed, the BPPT will expectedly help close the infrastructure gap in the distribution of petroleum products and stabilize petroleum product price in the riverine communities of the Niger Delta.

- Contract signed to build Maiduguri Emergency Power Project

The Nigerian National Petroleum Company (NNPC) Limited has commenced the construction of a 50-megawatt gas turbine power plant, the Maiduguri Emergency Power Project (MEPP), expected to generate electricity to the capital city and its environs. The NNPC Limited had announced a plan for the gas-powered plant in April as a long-term solution to the incessant attacks and destruction of power lines by the Boko Haram insurgents, who had frustrated attempts to restore power to the beleaguered city.

- Publication of NNPC 2020 Audited Financial Statement that posted N287 billion profit, the first of such in 44 years.

- Construction/Rehabilitation of 21 Roads under Federal Government’s Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The NNP Limited, on Tuesday, 21st December, 2021 handed over a N621bn Cheque to the Federal Ministry of Works and Housing for the project.

Over the years in office at the 45year-old behemoth Kyari has laid the foundation on which others can build momentum and deliver greater value to stakeholders.

Established on April 1, 1977 as Nigeria’s national oil company, the NNPC has been living in the dark shadows of a cesspool of monumental corruption and opacity; a place perpetually lagging behind its peers in other climes; where nothing is done properly and efficiency to the benefit of its shareholders, which are the Nigerian people.

Kyari knew NNPC needed a new vista and a break away from its decadent past. He saw his appointment as an opportunity of lifetime to give the NNPC a new direction in the way, its operations and businesses are well conducted, and give Nigerians a renewed hope.

Days after his inauguration, the reform-minded oil, and gas industry technocrat unfolded an agenda for NNPC’s rebirth. He called it the Transparency, Accountability and Performance Excellence (TAPE), a five-step strategic roadmap for NNPC’s attainment of efficiency and global excellence.

During the official unveiling of the TAPE agenda, Kyari said it was the only way to transform the NNPC and enhance its potential and capacity to compete with other national oil companies around the world.

Kyari told members of the NNPC’s Management team to buckle up, shape up, ship in with the new direction, or ship out with the old ways of doing things.

He identified the five steps for realizing the objectives of TAPE as:

NNPC opened up its systems to public scrutiny;

Its operational processes were made transparent and accountable to the Nigerian people and the government;

The new system would operate along with well-defined operational processes, benchmarked against established global best practices by world-class oil and gas companies;

Set the right operational cost structure, to guarantee value-addition towards NNPC’s sustained profitability, and

Set achievable goals, priorities and performance standards and criteria, by developing suitable governance structures for its strategic business units, and the entrenchment of team-spirit, work ethic and collaboration with all key stakeholders to achieve set corporate goals.

In his first 365 days at the helm of affairs at the NNPC, and as he resumes the next milestone of his tenure, stakeholders count his visible footprints of achievements across all segments of the country’s petroleum industry – Upstream, Downstream, Gas & Power as well as his interventions in other sectors to give Nigerians a new lease.

UPSTREAM INDUSTRY

Prior to Kyari’s appointment, the upstream sector of the country’s petroleum industry was facing a myriad of challenges. Prices at the international crude oil were experiencing a rapid decline.

Earnings from crude oil exports were significantly lower than the situation a few years ago. The average oil production volumes of 1.9 million barrels per day were significantly below the country’s approved 2.3 million barrels per day capacity in the 2019 Federal Budget.

New investments in the industry have stalled for several years as a result of the growing uncertainty over lingering issues that bordered on the poor operational environment. Key among the issues was the unresolved Petroleum Industry Bill (PIB), whose passage has continued to await the attention of the National Assembly and the government, fueling the pervading uncertainty among existing and prospective investors in the industry.

For instance, the final investment decision (FID) for the construction of Train 7 of the Nigeria Liquefied Natural Gas (NLNG) plant, which NNPC is the principal partner, could not be taken after several postponements and delays. Partners could not reach a consensus on certain fundamental issues.

Also, there were some unresolved disputes that involved some communities in the Niger Delta region and some oil companies, which affected oil exploration and production activities in the region.

NPDC’s Growing Output

The Nigerian Petroleum Development Company (NPDC), the upstream exploration and exploration subsidiary of the NNPC that is making new oil discovery to achieve st targets and objectives.

Operations at oil mining lease (OML) 25, known as the Kula oil field, was shut down on August 11, 2017, following a dispute between Shell Petroleum Development Company (SPDC) and a local oil company, Belema Oil Producing Limited (BPL) over interests in the operations of the oil field in the Belema Community area.

But, Kyari played a vital role in the dialogue that restored normalcy in the area. Shortly on assumption of office, he succeeded in mobilizing all the parties in the dispute to the table for peaceful resolution of the dispute on September 17, 2019.

Today, all the lingering issues, including the traditional injunction that stopped oil production at the OML-25 oil flow station have been amicably resolved and removed following his intervention.

A proposal of a roadmap for the development of the community was presented to the federal government and the NNPC in a new global memorandum of understanding (GMoU) granting the Belema community right to be involved in the maintenance and security of the oil facilities, while Shell remained the operator, along with the NPDC as its partner.

The OML 25 accounts for about 35,000 barrels of crude oil per day. The reopening of oil production activities in the area has been a major boost to NPDC’s output and Nigeria’s overall oil production capacity.

His intervention and dexterous resolution of all the conflicts that frustrated NPDC’s quest for increased oil production capacity repositioned the company to attain a new peak output of 331,400 barrels of per day on May 28, 2020. In the 2019 financial year, Kyari ensured the NPDC maintained a unit oil production cost of $16.5 per barrel per day.

Alternative Financing Deal For NPDC

Within the last one year, Kyari ensured the execution of a funding and technical services agreement (FTSA) as well as a alternative financing deal for NPDC’s OML 13 valued at about $3.15 billion and OML 65 for $876 million. These agreements resulted is a 32% and 21% incremental production output in OMLs 40 and 30.

14 companies participated in the auction for the financing and redevelopment of OML 119 operated by the NPDC. The twin offshore block comprises Okono and Okpoho fields located approximately 50 kilometres offshore south-eastern Niger Delta.

Revision Of Unit Costs for JVs, PSCs

Kyari has also saved costs for the government through NNPC’s revision of joint venture and production sharing contract (PSC) operators’ unit costs, down to $19 per barrel and $18.3 per barrel, from the initial $31 per barrel and $24.3 per barrel.

Concerned about the impact of high oil production cost on the government revenue, Kyari has, in the last one year, demonstrated commitment to achieving the industry target of reducing oil production cost to an average of $10 per barrel by 2021.

Under Kyari’s management in the last one year, the NPDC also acquired four new oil acreages (OMLs 11, 24, 116 and 98, while recovering debts for gas supplies totaling about N16.64 billion and $3.55 million.

In terms of gas development, Kyari has made significant progress in the development of an integrated gas handling facility, with the commissioning scheduled for the third quarter of this year.

Sustaining Average Oil Output

Despite the challenges in the oil and gas industry, Kyari was able to ensure the NNPC subsidiary in charge of the government investment interests in the oil industry joint venture projects, the National Petroleum Investment Management Services (NAPIMS), was able to achieve an average oil production capacity of 1.8 million barrels per day prior to the recent decision by the Organization of Petroleum Exporting Countries (OPEC) to cut its members’ output to boost crude oil prices and stabilize the oil market.

Kyari has also supported NAPIMS to secure external funding for the SPDC’s Santolina 3 projects expected to deliver an average production of 16,300 barrels of oil per day, while also superintending over the resolution of the Escravos gas-to-liquids (EGTL) cost dispute with Chevron Nigeria Limited (CNL).

The settlement agreement is expected to bring in additional $2billion to the Federal Government in the next 20 years, while providing about 1.5 million litres of diesel per day to the country.

He took steps to resolve the disputes that affected activities in other oil concessions. Following his intervention, the “signing of novation agreement between NPDC and the Nigerian Agip Oil Company (NAOC) involving the transfer of OMLs 60, 61 and 63 was formalized.

Nigeria LNG Train 7 FID

For almost two years, the final investment decision (FID) for the construction of Train 7 of the Nigeria LNG project was delayed, bringing things to a standstill.

When it seemed impossible at the height of the global pandemic, Kyari mobilised the NNPC and its JV partners, such as Shell, Total, and ENI, to execute the NLNG T7 FID on December 27, 2019. He went ahead to mobilize for the signing of the engineering, procurement and construction (EPC) contract for the project awarded to the Saipem, Chiyoda and Daewoo (SCD) JV Consortium.

The signing of the contract signaled the commencement of EPC activities for NLNG T7 Project. On completion, the production capacity of the six-train plant would expand by 35 per cent, from 22 million tonnes per annum (MTPA) to 30 MTPA, and increase Nigeria’s competitiveness in the global LNG market.

The NLNG Train 7 project has the prospects of further attracting foreign direct investment (FDI) in excess of $10 billion to Nigeria.

The FID on NLNG T7 Project was a sobering moment and important milestone achievement for Kyari, because the FID has confirmed that despite the downturn in the global economy, the partners in the projects were still willing and confident in Nigeria’s economy by agreeing to risk additional investment of over $10 billion after several postponements in the previous years.

Considered to be at the heart of the country’s economic growth, Kyari has pursued the execution of the project with single-minded commitment to see that it is completed on schedule in 2023.

The pipeline project represents phase one of the 1,300 kilometre-long Trans-Nigerian Gas Pipeline (TNGP) project being developed as part of Nigeria’s Gas Master Plan to utilize the country’s surplus gas resources for power generation as well as for consumption by domestic customers.

The TNGP project also forms part of the proposed 4,401 kilometre-long Trans-Saharan Gas Pipeline (TSGP) to export natural gas to customers in

Completion of Power projects

In the last one year, Kyari has mobilized to ensure the completion of the second phase of the Okpai Power Plant, with the first and second turbines lined up for commissioning in the third quarter of this year to guarantee the supply of electricity to the national grid.

To ensure the sustenance of gas supply to power plants in the country and other domestic users leading to a peak energy capacity of 111,591.83 megawatts-hour is attained, Kyari ensured the execution of a funding and technical services agreement (FTSA) with NPDC on OML 11, while taking the FID on the $3.5 billion West African Gas Project (WAGL).

In addition, Kyari has already ensured the successful execution of the intelligent pigging of the West African Gas Pipeline project as part of regulatory compliance and flow assurance, which is instrumental to achieving delivery of Nigeria-Gas foundation volume of 133 million BTU and cumulatively of more than 190 million BTU through the pipeline system this year.

Kyari has also ensured that the debts valued at over N80billion and $45million owed the NNPC, through its subsidiary in charge of gas development and supply, the Nigerian Gas Company (NGC) by gas off-takers, were recovered.

2020 crude oil lifting contracts

In August 2019, a few weeks after his inauguration, Kyari announced the issuance of fresh crude oil lifting contracts to 15 local and international oil marketing and trading consortia/companies under the 2020 DSDP scheme.

With the country’s four refineries still operating far below their installed capacities, and unable to produce enough to meet the country’s daily national consumption need for petroleum products, the 15 contractors were to utilize the 445,000 barrels per day crude oil allocation for local refining to bring into the country petroleum products for domestic consumers.

Kyari made a clear difference in the latest issuance of the oil lifting contracts as this was the first time since the DSDP programme began in 2016 that the corporation would make public the list of all the contract winners.

Revealing the names of the beneficiaries to the public was a new normal for NNPC as part of the policy direction, pledge and commitment of his management to transparency and accountability in NNPC’s operations going forward.

To sustain the era of uninterrupted supply of petroleum products, Kyari’s management team has continued to revamp downstream infrastructure to guarantee availability of 90 per cent pipeline for fuel distribution; ensure automation of the fuel distribution system, and raise NNPC Retail market share to 30 per cent.

“Operation White”

To build on the success of the DSDP programme, entrench energy security and deepen transparency in petroleum products supply and distribution, Kyari, in collaboration with the Minister of State for Petroleum Resources, Timipre Sylva, initiated an innovative programme, “Operation White”, to curb products diversion and smuggling, and ensure that the entire country was kept continuously wet with petroleum products.

Under the initiative, a team of 89 officials drawn from various government agencies involved in the petroleum products supply process was inaugurated, tasked with the responsibility of monitoring and tracking fuel distribution and consumption throughout the country.

The team included representatives from the NNPC, Department of Petroleum Resources (DPR), Petroleum Products Pricing Regulatory Agency (PPPRA), Petroleum Equalization Fund (PEF) as well as the Department of State Security (DSS).

Under the initiative, Kyari ensured actual volumes of petroleum products imported and consumed in the country were authenticated. The NNPC now has a customer express solution and online marketers’ portal, which is live for oil majors and Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN) to monitor loading and lifting of petroleum products from NNPC depots. Plans are on course for the system to go live for members of the Independent Petroleum Products Marketers Association of Nigeria (IPMAN) by the end of the second quarter of 2020.

Determining Nigeria’s National Daily Fuel Consumption

Kyari wants to eliminate the situation the Federal Government has not been able to determine the exact volume of petroleum products consumed daily in the country.

Various agencies have been presenting conflicting figures of the national fuel consumption volumes, ranging from about 35 million litres to 80 million litres per day. It was difficult to plan as a country.

Within few weeks of the “Operation White” initiative, the team forced down daily national consumption volume of premium motor spirit (PMS), popularly called petrol, from about 60 million litres to 52 million liters.

With the Federal Government’s border closure policy against its neighbours, NNPC curtailed the massive smuggling of petroleum products by unscrupulous elements across the Nigerian borders to other neighbouring countries in the sub-region. Since then, the national average has been between 45 and 50 million liters per day.

Refineries’ Rehabilitation

At inception, Kyari promised to ensure that all the county’s four refineries at Port Harcourt, Warri and Kaduna were fully rehabilitated by 2022, to transform Nigeria from being a net importer of refined petroleum products into net exporter of the commodity.

Apart from encouraging private investors, like Dangote Group and other mini-refineries developers in the country to be involved in the construction of private refineries, Kyari ensured his agenda for the rehabilitation of the four refineries were on course.

The plan to undertake the rehabilitation of Phase 1 of the Port Harcourt was to complement the supply of petroleum products from the strategic reserve.

Diversification Of NNPC’s Portfolio

Unlike most of its peers around the world, Kyari said the NNPC has for too long focused its operations on a single business line – exploration and production of oil.

Despite the abundant natural gas reserve in the country, the huge volume being produced by the oil companies are only through accidental encounters in the course of oil production. There is no deliberate policy or programme by the government to harness the gas resources to contribute to the economic development efforts of the country.

Kyari is repositioning NNPC with plans to expand its activities beyond its traditional operations to other unexplored frontiers, to grow its revenue streams, and cushion the impact of the volatility in the international crude oil market. This has seen the NNPC Retail Limited launch its range of lubricants into the Nigerian products market.

Kyari still wants the NNPC to continue to encourage the use of liquefied petroleum gas (LPG), otherwise known as cooking gas, among Nigerians in their domestic activities.

FINANCE & ACCOUNTS/OTHER ACHIEVEMENTS

Breaking 43 years Jinx with NNPC’s Audited Accounts

On assumption of office, Kyari promised the NNPC would embrace openness, transparency and accountability in his management approach. Despite pressures to dissuade him from opening up the system and break from the norm, Kyari kept his promise. He approved the regular publication of the Monthly Financial and Operational Report of the NNPC that highlight NNPC activities in the different aspects of the industry. Since 2016, the publication has been sustained.

Again, in 43 years of NNPC’s existence, its management was never able to release to the general public the audited financial statements and accounts of all its strategic business units (SBUs) and Corporate Services Units (CSUs). The best that has usually happened was the submission of limited copies of such reports in highly confidential covers for the files of some restricted government institutions, like the National Assembly.

Timely Remittance Of Oil Revenues To FAAC

But, under Kyari, NNPC has always ensured timely and regular remittances of all revenues accruable to the Federation Accounts Allocation Committee (FAAC) for distribution to the three tiers of government.

Revenue optimization

Kyari has made it a policy of his management in the last one year to ensure revenue optimization by the NNPC in all its activities. In all NNPC’s projects, Kyari has always ensured all JV partners adhered strictly to efficient operational processes established by the NNPC under his management, to achieve cost conservation and allow the NNPC to deliver its business objectives at such low costs and reduced budgets, to guarantee steady revenue flows to the federation account.

Alternative Funding Arrangements

Kyari has secured several alternative funding mechanisms and financing deals for the NNPC and its partners, to save the government the headache of cash calls for oil and gas industry projects.

One of such has seen Kyari secure about $3.15billion funding for NPDC’s OML 13; $876 million for OML 65, and $3.4 billion for OML 11. Besides, Kyari has also concluded the necessary processes for a $1.8 billion financing for the AKK pipeline project as well as executed a term sheet with the Bank of China to raise escrowed $519 million from internal cash flows to support equity funding of oil and gas industry projects in the country.

He also achieved financial closure for ‘Project Eagle’ by raising $1billion for the NPDC through a Forward Sale Agreement (FSA), while also negotiating a term sheet with AFREXIMBANK for the $1billion funding for the Port Harcourt Refinery and Petrochemical Company (PHRC) rehabilitation project.

Recruitment Of Graduate Trainees

Kyari has implemented NNPC’s People Strategy to address organizational optimization, resourcing, capacity development, retention, succession planning, compensation and rewards by recruiting onboarding and integrating 1,050 fresh graduates into various departments of the NNPC operations.

End to Fuel Subsidy

For years, the Federal Government lost to fuel subsidy several billions of Naira that could have been used to provide other basic infrastructures for the people, like roads, hospitals, schools and other social amenities.

Each time any attempt was made towards the removal of subsidy by the government from the fuel pricing template of the PPPRA, there was stiff resistance by the Nigeria Labour Congress (NLC) and other categories of Nigerians, who always threatened to embark on nationwide strikes capable of crippling the country’s economy.

Highest Oil Output Despite Challenges

As of December when the Federal Government approved the 2020 Federal Budget, crude oil benchmark price was put at about $57 per barrel. But, by April, within a few months of the outbreak of the coronavirus pandemic, the price dropped to an all-time low level of less than $12 per barrel.

Despite the impact of the coronavirus pandemic, which ravaged the global economy and impacted the international oil market, Kyari said the NNPC achieved the best performance during the crisis period.

This was made possible with the deployment of the latest technology under NNPC’s Business Continuity Plan activated during the crisis period to connect with its partners’ locations to sustain operations across the business value chain, despite disruptions and slowed down economic activities.

“What the NNPC did was to engage with its partners to bring down the high cost. We negotiated contracts, cut down on contract’s life cycle; select the right projects; engage the right institutions to bring down the cost. Our ultimate target is to bring the cost to at most $10 per barrel,” Kyari said.

As the Nigerian National Representative to the Organization of Petroleum Exporting Countries (OPEC), Kyari joined other members of the group to seek for solutions to the declining crude oil prices, which appeared to have impacted more on Nigeria, whose economy depended on more than 8o per cent oil revenues.

Kyari and the Minister of State for Petroleum Resources, Timipre Sylva joined OPEC to resolve on a programme to cut the crude oil output of its members by about 10 million barrels between May 2020 and April 2022.

However, Kyari said after the OPEC+ output cut programme in April 2022, NNPC’s target is to raise Nigeria’s oil production from 1.579 million barrels per day 3 million barrels per day and national oil reserve of about 35 and 40 billion barrels.

Kyari said NNPC has projects already in line to come on stream between 2021 and 2022 to bring incremental crude oil production volumes in excess of 600,000 barrels per day.

Reviving Moribund Subsidiaries

Apart from the diversification of the portfolios of its investment to create wealth, Kyari said NNPC is pursuing its drive towards profitability, by reviving its moribund subsidiaries and providing the building blocks for stronger strategic business units (SBUs) and Corporate Services Units (CSUs) to rake in more revenue to support the overall growth of the corporation.

Over the years, some of the SBUs remained largely financially dependent on the support from their parent company and hardly able to meet their obligations towards the discharge of their mandates.

For instance, the IDSL in Benin, which is supposed to be responsible for all the seismic data the NNPC requires in its oil and gas exploration activities, and its technical and engineering arm, NETCO in Lagos, which was supposed to make the technical and engineering inputs were all dormant for years.

But, since Kyari came to office, the two entities have not only been revamped and made to stand on their feet, they are now operating profitably and involved fully in the performance of their official functions in support of the entire NNPC business chain.

In the last one year, IDSL achieved 20% year-on-year revenue growth and completed eight reservoir studies alongside the upgrade of IDSL’s Data Processing Centre.

Also, IDSL has obtained an Integrated Management System (IMS) Certification in ISO 14001:2015 (EMS), ISO 9001:2015 (QMS) and ISO 45001: 2018 (OH&SMS), while NETCO executed 729,771 man-hours against a plan of 660,000; which is 11% above plan. Revenue performance from the agencies as shown in the NNPC audited actual plan about N38.05billion and N25.77billion respectively, which is 48% above plan.

Oil drilling in Kolmani River 11

For several years, the search for oil by the NNPC in the country’s inland sedimentary basins, particularly in the northern part, did not result in any successful commercial oil discovery, despite the huge resources deployed by the Federal Government into the exercise.

Kyari said during the year the NNPC discovered hydrocarbon deposits in commercial volumes in the Kolmani River II Well on the Upper Benue Trough, Gongola Basin, in the North Eastern part of the country.

The oil well was to evaluate Shell Nigeria Exploration and Production Company (SNEPCo) Kolmani River 1 Well Discovery of 33 BCF and explore deeper levels.

Kyari said the discovery of oil and gas in commercial quantity in the Gongola Basin would attract foreign investment, generate employment for people to earn income and increase in government revenues.

Benchmark For Legal Arbitration

Over the years, the NNPC has been spending a huge fortune on legal fees to defend itself against several litigations against foreign interests around the world.

When Kyari assumed office, the NNPC ha an arbitration case over a failed gas contract in the United States that dragged for years. Using foreign lawyers would have cost the NNPC about $3billion in legal fees.

But, Kyari said in line with his management’s two-pronged approach of performance and excellence across all departments and units of the corporation, NNPC lawyers would handle the case.

He said the idea was to entrench a high level of efficiency anchored on proficient implementation of business processes to emplace an appropriate reward system for exceptional performance among the NNPC workforce.

Kyari did not see spent billions of Naira to hire foreign legal experts to represent NNPC’s interest in courts abroad as appealing option, particularly where there were several qualified and competent Nigerian lawyers and legal experts on the corporation’s payroll doing nothing.

He approved that NNPC lawyers from Nigeria should travel to the United States to defend the corporation. The representation from the Corporation’s legal department not only succeeded in its assignment, it set a legal benchmark for the NNPC going forward.

Leadership For Oil Industry Fight Against COVID-19

Kyari has led the oil and gas industry’s effort to support the government to limit the dread of the deadly Coronavirus pandemic in Nigeria.

His achievements are too important to be appreciated only within the local environment. This underpins our zeal to take his profile to the stars beyond the sky.